If The Shoe Doesnt Fit, There Is No Sale

When customers make their buying decisions, they narrow their choice to two or three items. Perhaps a couple of different styles, colors, or patterns. So what is the one thing that these final choices always have in common?

The answer is so fundamental that we often dont even think about it. If it doesnt fit, it doesnt fit. And if it doesnt fit theyre not going to buy it. Period.

The problem is that we, as retailers, tend to lose sight of this fundamental factor; or we downplay how critical it is. We allocate the same size mixes to every store in multiples of prepacks.

While this may be a bit more efficient for our vendors and our distribution centers, it severely undermines our margins. We pile too many of the wrong sizes in our stores while at the same time we short those same stores in the sizes they really need. Even though we may have allocated the right quantity of a style/color to a store, our margin gets eroded by markdowns in some sizes and by lost sales in other sizes.

Given that we want our customers to have the great shopping experience that goes along with finding the merchandise they wantin their sizeand given that we all want to optimize our gross margin, it makes sense for us to examine sizes a little closer.

1. Each store has its own unique ideal size mixknow it, use it!

Each store has its own unique ideal size mix. The stores size mix is determined by the demographics of the people who shop at that store. To optimize our margins, we need to determine each stores unique size mix, and allocate that size mix to the store in every style/color we send out.

Now you might be thinking, If I have 100 stores, is each stores size mix really unique? Couldnt I just come up with three size mixes: one skewed to small sizes, one balanced and one skewed to large sizes?

While that seems intuitively obvious and appealing, real-life data just does not support this theory/approach.

When looking at real-life data, the ideal size mixes vary dramatically from one store to the next. This is true time after time, merchandise category after merchandise category, retailer after retailer, without fail. Which leads us to, ¦

2. Ideal size mixes are not bell-shaped curves,

Or any other standard curve for that matter.

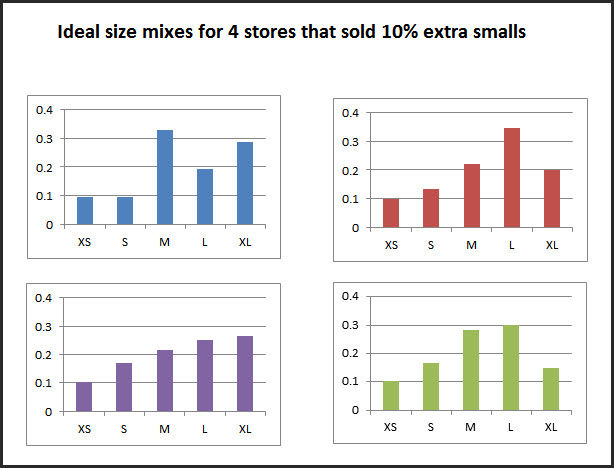

Without evidence of real-life data, it would be easy to think that if a store sells a large percent or extra-smalls, say 10%, youd have a pretty good idea of what they sold in smalls, mediums, larges and extra larges.

Turns out, however, that demographics are much more complex and varied. Take a look:

Surprising, isnt it? This is what varying demographics do. At Lauzau And Associates, weve seen that 1) this is typical, and 2) if you are not addressing it, you are not optimizing your gross margin.

This picture alone totally changed and deepened our appreciation of the importance of each stores unique ideal size mix in keeping customers happy and maximizing margins.

3. Prepacks Sure youre saving money, but are you saving more than youre losing?

Some of the great metrics for warehouse performance are units-per-hour and cost-per-unit. It makes a lot of sense to closely watch how much variable cost is added to the product as its processed through the DC. For this reason, prepacks seem like an obvious solution. The theory is that if it takes the same amount of time to handle one prepack of 10 units as it does to handle a single loose item, then it is 10 times more efficientand the result should be a cost reduction of 90%.

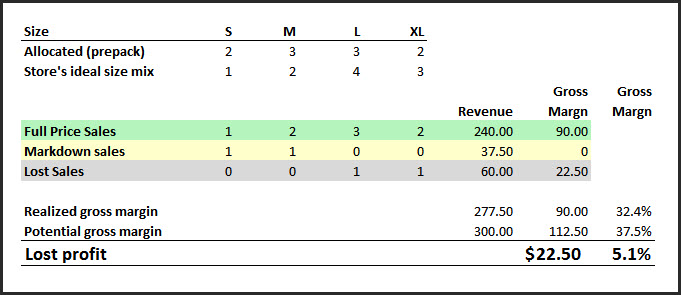

The problem is that youre saving pennies in the DC while losing dollars in the stores. Again, heres a picture to illustrate the reality.

Lets say you have an item that retails for $30 with a 60 percent markup (cost $18.75, gross margin $11.25). You are allocating it out in 2:3:3:2 prepacks, whereas a given stores ideal size mix is actually 1:2:4:3. If we say that markdown items are sold at-cost, heres what you get:

Yikes! Thats a 5.1 percent drop in the gross margin percent. Who knows how much you saved in distribution cost, but you are very far from maximizing your profit. And this was for a relatively minor difference between the prepack size mix and the ideal size mix; meaning, it could be worse, maybe even much worse.

NOTE:Whether or not you are using prepacks, if you are not allocating to each stores unique ideal size mix, youre going to get similar results.

4. Lost sale + lost sale + lost sale = lost customer

How many times can you lose a sale with a customer due to sizing before you lose them as a customer? Hard to say. Do you really want to take the odds in that bet?

5. Is there still a place for prepacks?

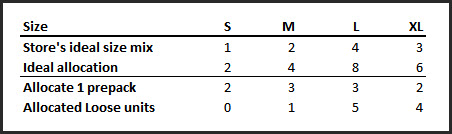

Depending on how many units youre allocating, it is possible to use a combination of prepacks and loose pieces to distribute each store their ideal size mix. In the example above, if you wanted to allocate 20 units to a store, heres how you could do it:

This would give us 11 touches in the DC (versus 20!) while still making sure youre maximizing your gross margin.

6. Buying the right sizes to start with

To have the right sizes in the DC to allocate each store the sizes they need, you need to order the right total size mix from the start. If you dont order the right overall size mix, youre compromising your gross margin from its infancy. You are locking in markdowns and lost sales from the moment you commit to the merchandise. Unfortunately, this is pretty much common practice. A lot of effort and thought goes into selecting just the right styles, colors and patterns while the size mix is pretty much, kind of, sort of eyeballed.

Lets change that. Lets optimize your margins with the right size allocations and order.

Epilog

This article is about understanding the importance of each stores own unique ideal size mix.

Future articles will discuss how to determine each stores unique ideal size mix, ways to use store-level size mixes in allocations, and the best means of determining overall size mix for ordering.

In the meantime, please share your thoughts and insights about this article. Ill look forward to hearing more.

Dave Lauzau

614.729.2180

dlauzau@lauzau.com

www.linkedin.com/in/davelauzau

www.Lauzau.com